Markets Update: A Quarter in Review

ECONOMY

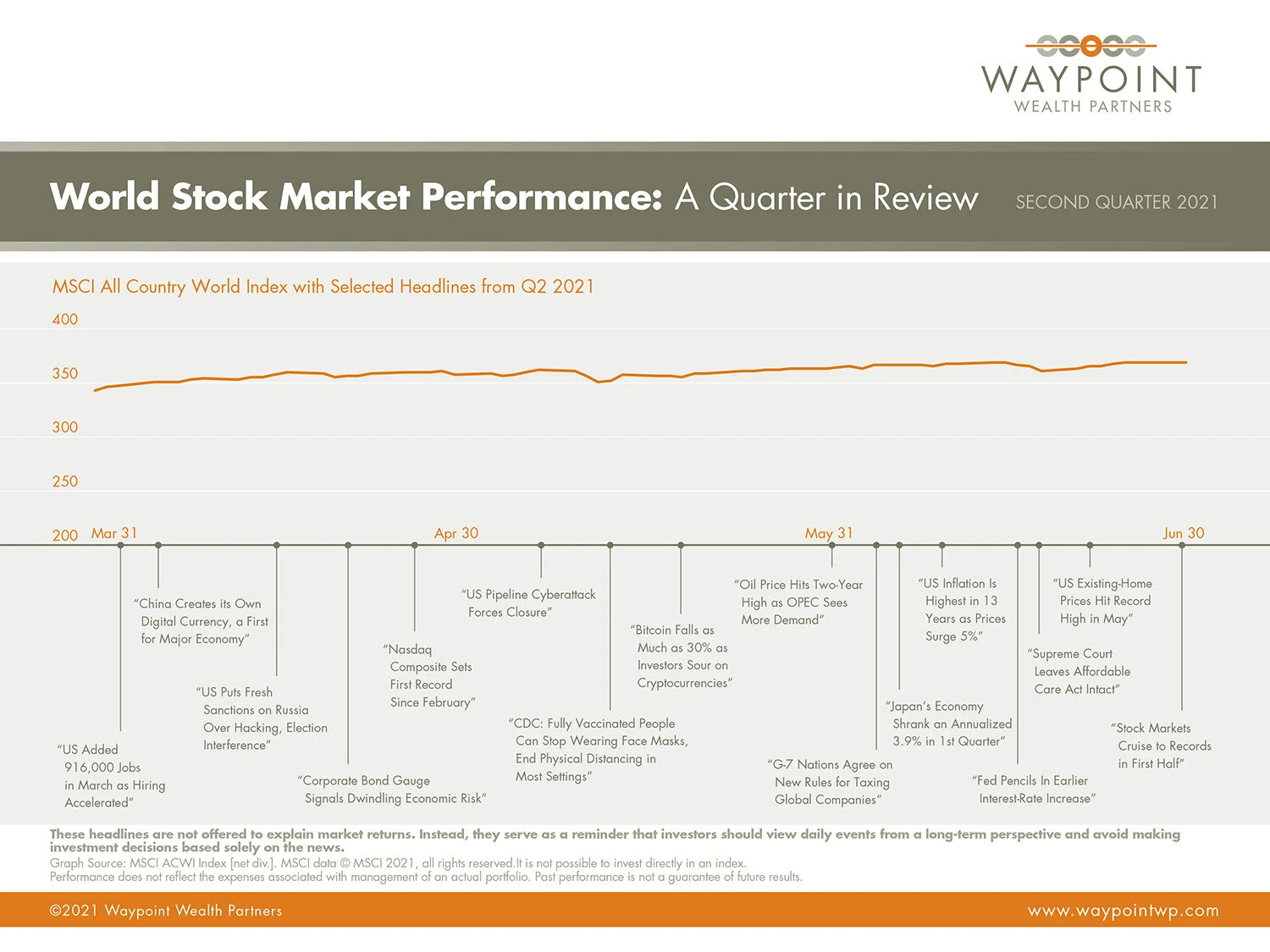

It was a strong quarter for global growth and global markets. Advances were driven by expanding vaccinations, relaxation of shutdown measures and the flood of economic activity from reopening coupled with pent-up demand and continued accommodative fiscal and monetary policy. GDP growth is expanding rapidly, both domestically and overseas. Global corporate earnings and forward estimates generally remained upbeat amid improving economic data. In the U.S., the unemployment rate remained a concern, edging higher and remaining well above its pre-pandemic level. Conditions should therefore remain accommodative.

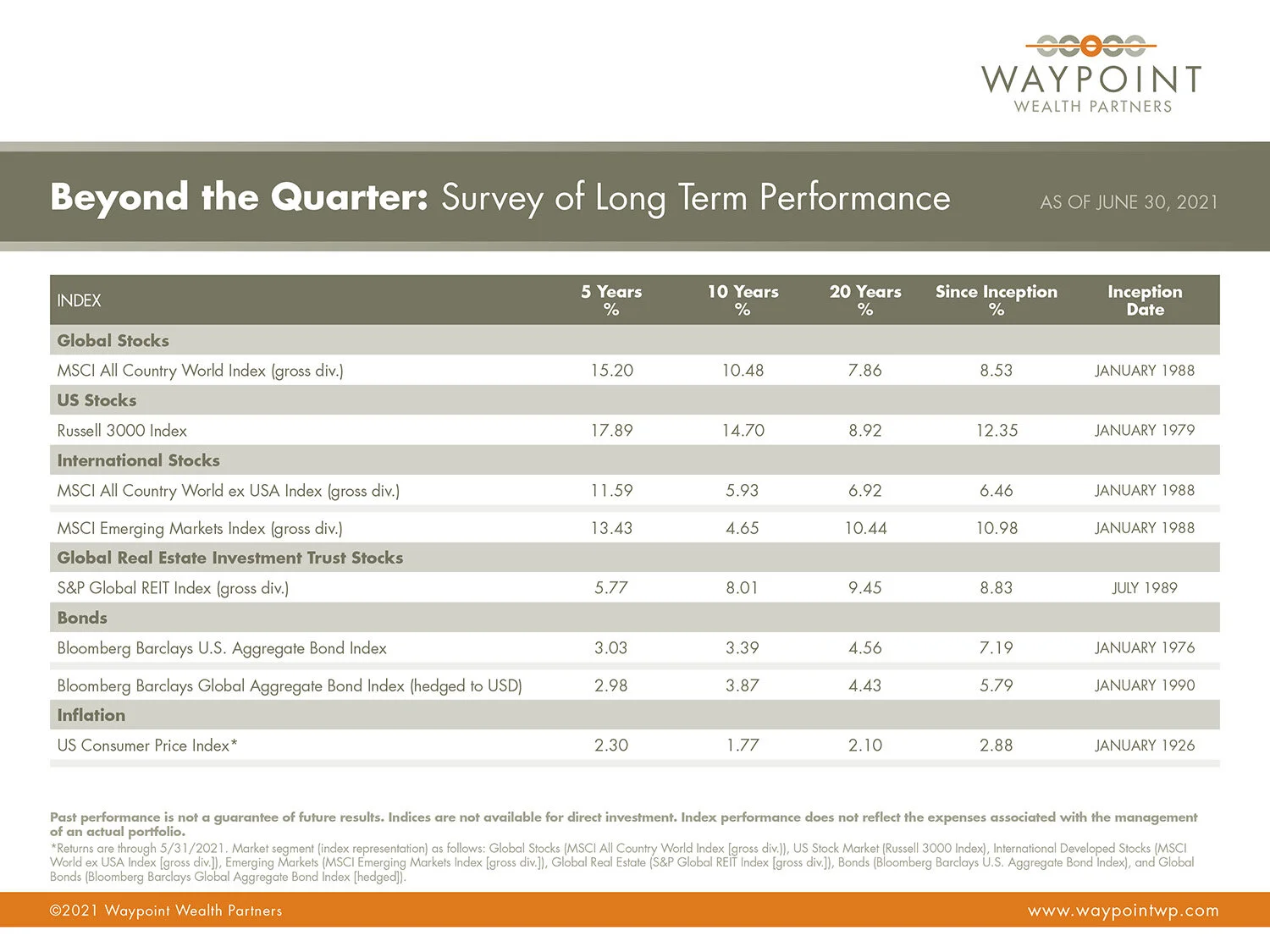

U.S. GDP measured 6.4% in Q1 and should prove to be even higher when we get the official Q2 reading. The Fed raised its 2021 growth forecast to 7%. That is 3.5x faster than a base case growth rate for the U.S. based on economists’ estimates given labor participation and productivity, and quicker than many imagined a year ago. These conditions support further strength in corporate earnings. Our investments in global stock and bond markets should continue to benefit from this positive macroeconomic environment.

Prices for things like used cars, lumber, and gasoline have made headlines. These price spikes make sense given the pent-up demand and limited supply coming out of the complete economic shutdown we experienced last year. Some measures appear to have peaked in mid-May in things like lumber and corn; others, like higher used car prices, are persisting due to semiconductor chip shortages. Sifting through the noise and remaining laser focused on a long-term disciplined investment process is the key to successful investing.

STOCKS

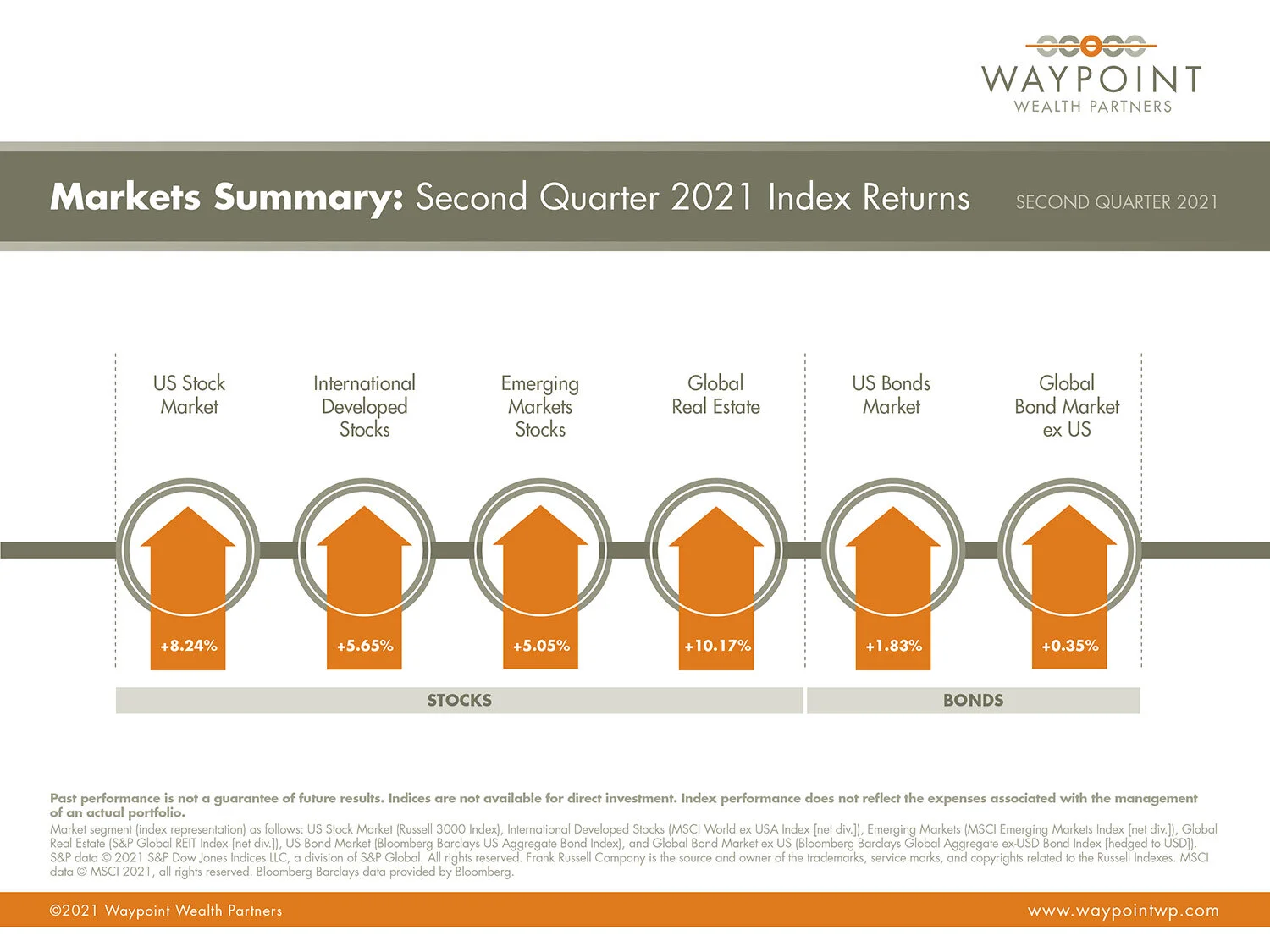

Global equities again posted strong returns this quarter led by U.S. stocks with an 8.24% gain. Despite accelerating inflation, some typical volatility, and more hawkish comments from the Fed, the S&P 500 Index delivered its fifth straight quarterly advance. The larger cap U.S. index ended the second quarter with its 34th record close of the year, and we expect more to come in the second half of 2021. International developed stocks returned 5.65%, while emerging markets stocks gained 5.05%. Global real estate securities notched double digits, returning 10.17% for the quarter.

Year to date, small-cap stocks outperformed large caps, and value stocks significantly outperformed their growth stock counterparts, particularly in the small-cap space. Market premiums often come in spurts which is what makes them so difficult to capture through timing and helps explain why patience and discipline are so essential to our long-term investment process.

BONDS

In a reversal from Q1, U.S. Treasury yields declined in June and for the second quarter overall, even as inflation edged higher, economic data generally improved, and the Fed slightly accelerated its rate-hike outlook. At its mid-June meeting, the Fed committee altered its fed funds rate forecast suggesting two rate hikes by 2023, previously the expectation was in 2024 at the earliest. However despite that shift, policymakers left their $120B monthly bond purchase program (QE) intact for now.

Against this backdrop, the broad U.S. bond market advanced and outperformed global bonds. Gains among U.S. Treasuries and corporate bonds largely accounted for the U.S. investment-grade bond market’s positive quarterly returns. Mortgage-backed securities advanced slightly for the quarter. Short and intermediate-term municipal bonds both returned less than 1% for the quarter, while the Bloomberg Barclays Muni Bond Index, which includes longer-dated bonds, advanced 1.42%.

Despite some of the aforementioned headwinds in the bond market (potential QE tapering and interest rate raises by the Fed, and higher inflation), owning high quality bonds remains an important part of our overall investment strategy in that they provide diversification, liquidity, and dry powder in the event of a stock market pullback.

——

Topic of the Quarter: Do Downturns Lead to Down Years?

Stock market declines over a few days or months may lead investors to anticipate a down year. But the US stock market had positive returns in 16 of the past 20 calendar years, despite some notable dips in many of those years.

Intra-year declines for the index ranged from 3% to 49%.

Many years with large intra-year declines saw positive annual returns.

In 16 of the last 20 years, US stocks ended up with gains for the year.Even in 2020, when there were sharp market declines associated with the coronavirus pandemic, US stocks ended the year with gains of 21%.

Volatility is a normal part of investing. Tumbles may be scary, but they shouldn’t be surprising. A long-term focus can help investors keep perspective.

——

Past performance is no guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio .In US dollars. Data is calculated off rounded daily returns. US Market is represented by the Russell 3000 Index. Largest Intra-Year Decline refers to the largest market decrease from peak to trough during the year. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful.

——