Fall 2019 — find out what the WWP team is doing after hours.

Checks and Balances

“Democracy is the worst form of Government except for all those other forms that have been tried from time to time.” – Winston Churchill

Last quarter we wrote about the ongoing trade situation between China and the U.S. and the potential risk it poses to the global economy through creating a “wait and see” mentality for businesses. We are still waiting to see how this escalates or resolves, meanwhile actual harm is starting to show in the agriculture and manufacturing industries. This quarter, when we started framing our outline, we had planned on focusing on the economy – short answer is the economy is still growing, but anemically. Instead, given the ties between markets and politics, we find ourselves writing about the importance of checks and balances in our political system, in our economic system, and in your portfolios.

A Quarter in Review: Third Quarter 2019

Uncertainty has become the central theme around investing, economics, and geopolitics in 2019. This uncertainty has led businesses to defer investment and could lead to a slowing in hiring, both of which threaten to push the economy close to recession. Global Central banks quickly pivoted from raising interest rates in the latter half of 2018 to cutting interest rates this year in reaction to a slowing economy. We expect rate cuts to continue with the likelihood of one additional rate cut occurring in the U.S. already being priced into the market. With this, discipline around diversification and rebalancing remains very important in your portfolios.

Archived - Behind the Scenes Q2 2019

“Wait and see…”

Wait and see! These three simple words plagued our childhoods. Hearing them was about as satisfying as their counterparts “because I said so” and “we’ll get there when we get there.” As with our childhoods, these three words are far from a satisfactory answer to how global trade conflict will resolve.

A Quarter in Review: Second Quarter 2019

To date 2019 has been a year of superlatives. The strongest January market returns since 1987, the lowest weekly U.S. jobless claims since 1969 and the longest U.S. economic expansion on record. On the flip side, we have the weakest eurozone manufacturing data since 2010, the flattest U.S. yield curve since the global financial crisis and tariffs at their highest level in half a century. The actual tariff levels remain relatively small, but the trade dispute is having a tangible impact on markets and the global economic outlook.

A Quarter in Review: First Quarter 2019

Coming into the year, there were two big unknowns that scared investors – trade war and interest rates. Investors received more clarity on each in January and the markets staged an impressive rally. Trade tensions eased in January when early indications pointed to constructive dialogue and meaningful progress between the U.S. and China surrounding trade. This increased the probability of a trade agreement happening later this year. More importantly, investors received favorable news on interest rates when the Federal Reserve Chairman announced a plan to stop raising interest rates this year.

Volatility Defined 2018

Volatility defined 2018. The calm waters of 2017 were overtaken by waves of volatility, making it a stressful year for investors. The stock market had some highs in 2018 but could not sustain the momentum as investors struggled to navigate murky, uncharted waters. Stocks constantly wavered back and forth from excitement to gloom and doom, unable to find a clear path in either direction until the fourth quarter.

Annual Market Review 2018

There were not many places to hide in 2018 – all major asset classes had negative returns except cash and bonds. Investing in conservative assets such as cash and bonds would have been the right place to be last year but extending the time horizon tells a different story. Over the past 10 years, global stocks returned 9.5% while cash returned 0.2% and bonds earned 3.1%. Short-term returns can vary from year-to-year, but history shows long-term investors get rewarded for the risk they take.

Time heals all wounds?

September 15th, 2018 marked the 10-year anniversary of Lehman Brothers bankruptcy. Many historians will point to this seminal moment in history as the spark that ignited the Great Financial Crisis. At the time of collapse, Lehman Brother’s had been around for over 150 years and it was the fourth largest investment bank in the country. A failure of this magnitude was unimaginable. Shockwaves were sent throughout the global financial system as investors began to realize the toxic debt that brought down Lehman was owned by nearly all major financial institutions. In a blink of an eye, fear penetrated the capital markets and credit markets froze. Mistrust of the financial system brewed throughout the country and echoes of panic grew louder with every passing day. The viability of our entire country’s banking system was put into question as total panic took over. The financial damage that followed was devastating.

A Quarter in Review: Third Quarter 2018

Uncertainty surrounding global trade continued to dominate headlines in capital markets. Trade tensions escalated when the Trump Administration imposed a 10% tariff on $200 billion of Chinese goods. China immediately responded by increasing tariffs on $60 billion worth of U.S. goods. For now, the good news is the stock markets were relieved the number of tariffs imposed were less than anticipated. Investors are hoping these actions are a negotiation ploy versus an intention to start a full-blown trade war. We cannot predict when or if the trade issues will get resolved, but we hope to see cooler heads prevail with a trade agreement that satisfies both sides.

“Many Reasons to Hate Bonds, a Few Important Reasons to Own Them”

Financial news surrounding bonds has been very negative as of late with industry experts sounding the siren on bonds. Bill Gross, the “bond king”, tweeted that the “bond bear market confirmed.” Ray Dalio, a legendary hedge fund investor, warned, “a rise in yields could spark the biggest crisis for fixed income investors in almost 40 years.” Higher inflation, increased deficit spending, monetary tightening, and negative returns year-to-date are often cited as reasons to hate bonds, but the one that gets the most attention is rising interest rates.

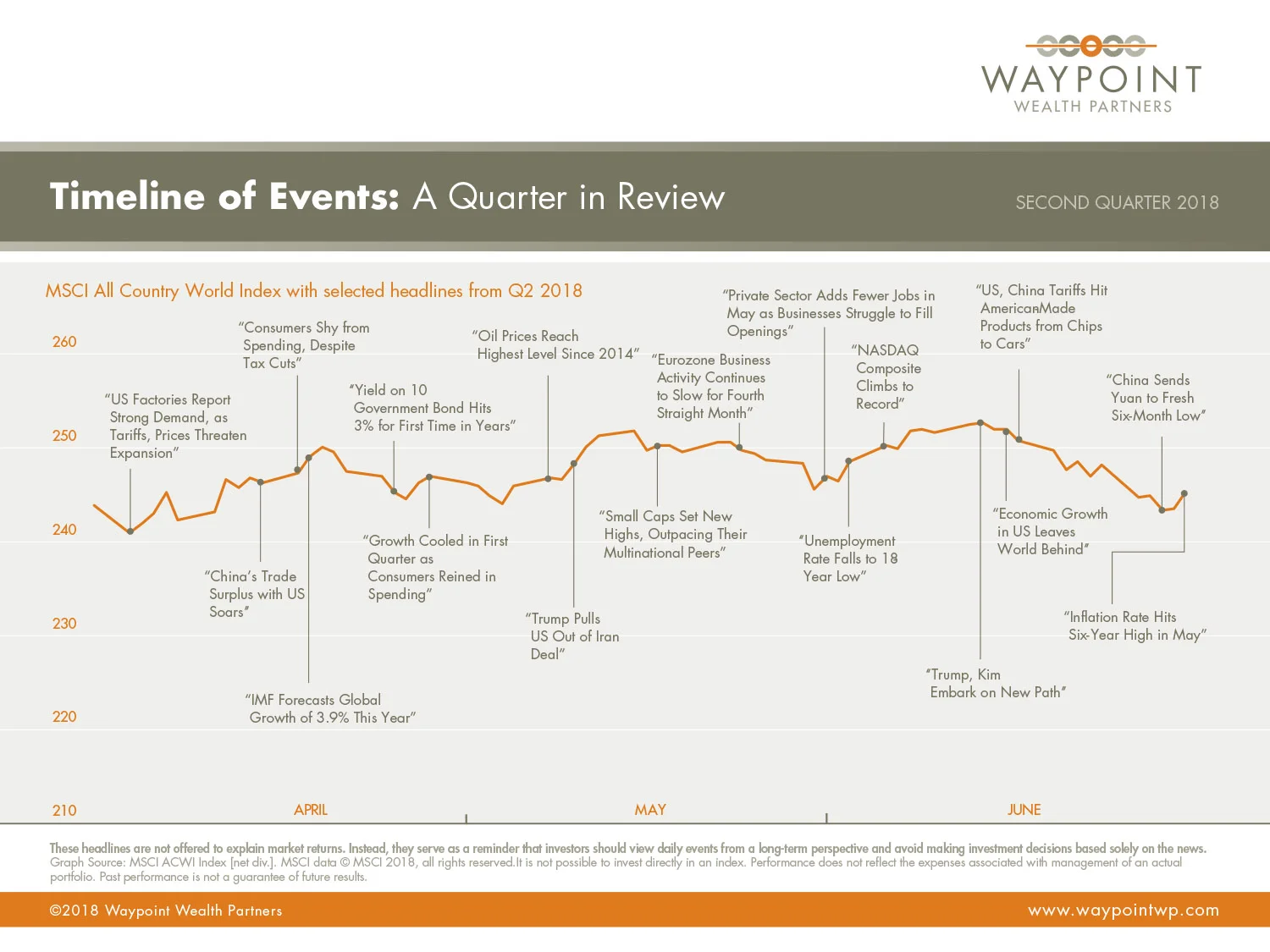

A Quarter in Review: Second Quarter 2018

Market volatility continued in the second quarter as trade war fears took center stage. As of this writing, the U.S. has imposed tariffs on about 2% of all U.S. imports, while other countries have placed tariffs on 1% of all U.S. exports. Tariffs at these levels have minimal impact on our economy, but uncertainty around how far and deep they will go will continue to put a lid on the markets. Protectionist measures lead to higher inflation and slower economic growth, hurting all parties involved. The possibility of an outright trade war is overshadowing really strong earnings and positive economic growth around the world.

Volatility Is Back!

2017 was one of the least volatile periods on record for the stock market. S&P 500 had a positive return every month and the largest decline during the year was 3%. Near perfect investing conditions with global synchronized economic growth, low inflation, strong earnings growth, deregulation, and low interest rates conditioned investors to indiscriminately buy equities without fear, propelling stocks to historic levels throughout the year without much volatility.

A Quarter in Review: First Quarter 2018

The first quarter of 2018 was a stark contrast from last year, with almost every asset class in negative territory. In 2017, events that typically move market prices such as war threats, political scandals, rising interest rates, and natural disasters failed to drive volatility higher. What a difference a quarter makes. Suddenly, what was once ignored came into focus for market participants – tightening monetary policy, above average valuations, inflation data picking up, and trade protectionism. Ironically, volatility and market reactions to data are signs of a healthy market. The market correction we experienced in the first quarter was a much needed reprieve. Consistently earning positive returns month over month was an unsustainable path that would have led to frothy, bubble like conditions. Despite recent volatility, we are encouraged by the fundamental underpinnings of the market as corporate earnings and global growth continue to accelerate.

Archived - A Year in Review: Fourth Quarter 2017

2017 was a tremendous year for investors across the globe with every major asset class finishing positive for the year. Capital markets and world economies grew much faster and stronger than many anticipated coming into the year. It was a year in which political scandal, natural disasters, threat of nuclear war, and cyber hackings could not derail the momentum in stocks. Positive factors such as loose monetary conditions, low inflation, reduced regulatory burdens, corporate tax cuts, and strong earnings growth outweighed the negatives and created an environment that favored risk assets. For investors that remained disciplined and invested, this was a year to remember.

Archived - To Bit or Not to Bit: What Should Investors Make of Bitcoin Mania?

Archived - A Quarter in Review: Third Quarter 2017

Third quarter results were strong across the board with every major asset class earning positive returns. Markets looked past the string of natural disasters, elevated threats of war with North Korea, and increased political noise to reach new highs during the quarter. Investors continued to benefit from loose monetary conditions, solid economic data, and low inflation. This type of environment is often referred to as a “Goldilocks Economy”, one that is not too hot to spur inflation or not too cold to cause a recession. The backdrop is just right for stocks. These factors have fostered a benign environment for stocks as investors enjoy extremely low volatility. The best example of this is the S&P 500’s performance this year. The S&P 500 experienced the shallowest pullback in history with a drawdown of only 3% this year.

Archived - Effects of Natural Disasters

North America has been hit with a series of devastating natural disasters. Mexico had two powerful earthquakes over 7.0 in magnitude that devastated the country. Hurricane Harvey decimated parts of Texas and Louisiana, Hurricane Irma wreaked havoc on Florida, Hurricane Maria ravaged Puerto Rico and the Caribbean, and most recently the North Bay fires destroyed thousands of homes and businesses. The human tragedy is immense and the road to recovery for those impacted will be a long and arduous one.

Archived - A Quarter in Review: Second Quarter 2017

Investors have enjoyed a period of calm markets with stocks and bonds providing positive returns without much volatility. Through all of the uncertainty and risks in the market, it has been uncharacteristically quiet. Over the past year, we have been confronted with the threat of war, terrorist attacks, Brexit, scandals in Washington D.C, and corporate scandals. These events typically trigger fear and volatility, but the markets have shrugged it off. It has been over 250 days since the last 5% fall in the S&P 500 index. The Federal Reserve has played a major role in this anomaly. The capital markets have been supported for years through unprecedented quantitative easing – providing ample liquidity and cheap financing through low interest rates. Things are beginning to change as the Federal Reserve starts to normalize interest rates. What are the ramifications of eight years of zero interest rate policy? How will the Federal Reserve unwind their balance sheet? The outcome of this is impossible to predict, but what we can expect is for this low volatility backdrop we have enjoyed to not continue as the market adjusts to this new environment. Volatility in the market is normal and creates opportunities for investors. Warren Buffet said it well, “Look at market fluctuations as your friend.” It is a sign of a healthy and functioning market.