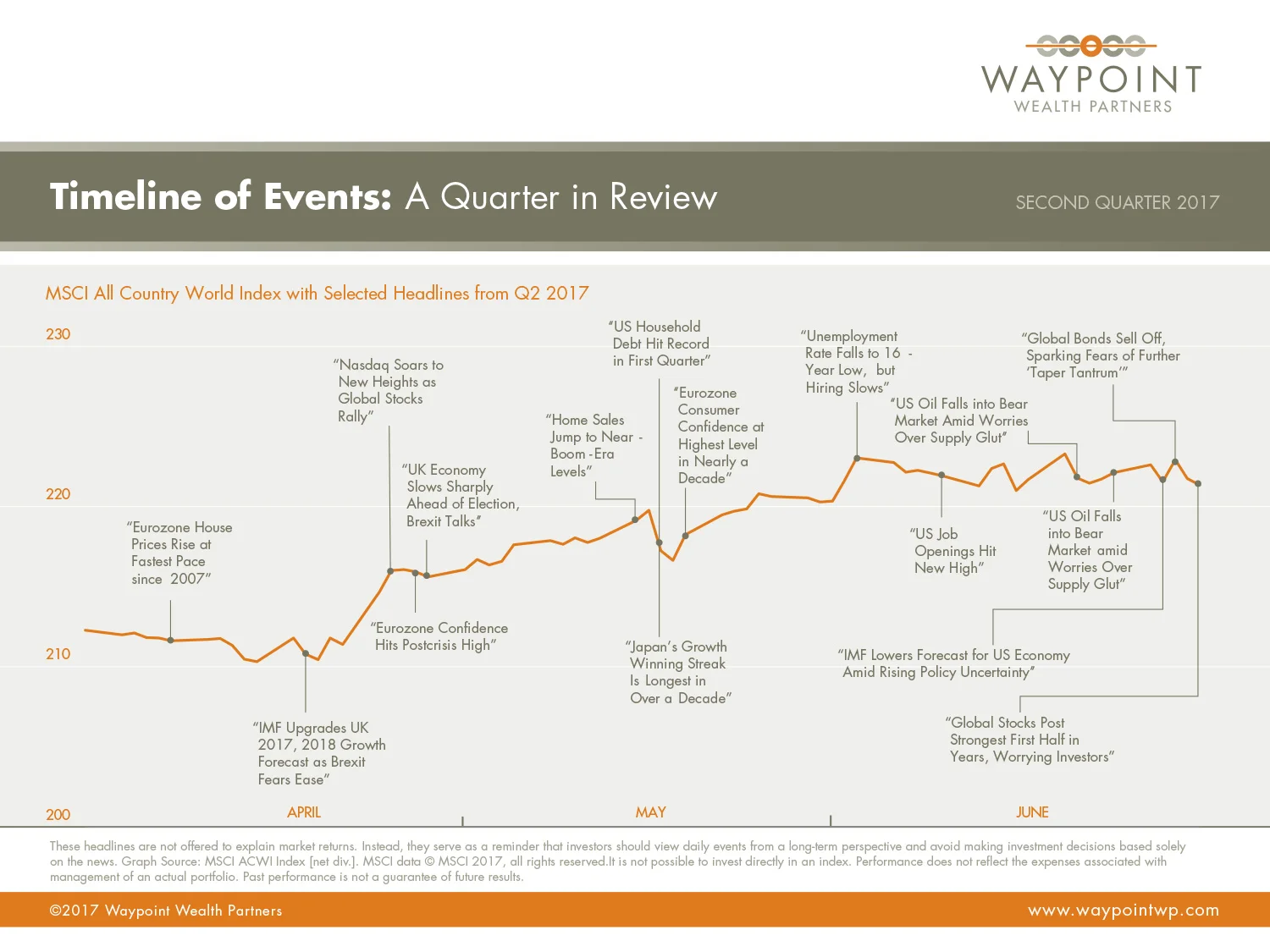

Investors have enjoyed a period of calm markets with stocks and bonds providing positive returns without much volatility. Through all of the uncertainty and risks in the market, it has been uncharacteristically quiet. Over the past year, we have been confronted with the threat of war, terrorist attacks, Brexit, scandals in Washington D.C, and corporate scandals. These events typically trigger fear and volatility, but the markets have shrugged it off. It has been over 250 days since the last 5% fall in the S&P 500 index. The Federal Reserve has played a major role in this anomaly. The capital markets have been supported for years through unprecedented quantitative easing – providing ample liquidity and cheap financing through low interest rates. Things are beginning to change as the Federal Reserve starts to normalize interest rates. What are the ramifications of eight years of zero interest rate policy? How will the Federal Reserve unwind their balance sheet? The outcome of this is impossible to predict, but what we can expect is for this low volatility backdrop we have enjoyed to not continue as the market adjusts to this new environment. Volatility in the market is normal and creates opportunities for investors. Warren Buffet said it well, “Look at market fluctuations as your friend.” It is a sign of a healthy and functioning market.

BONDS

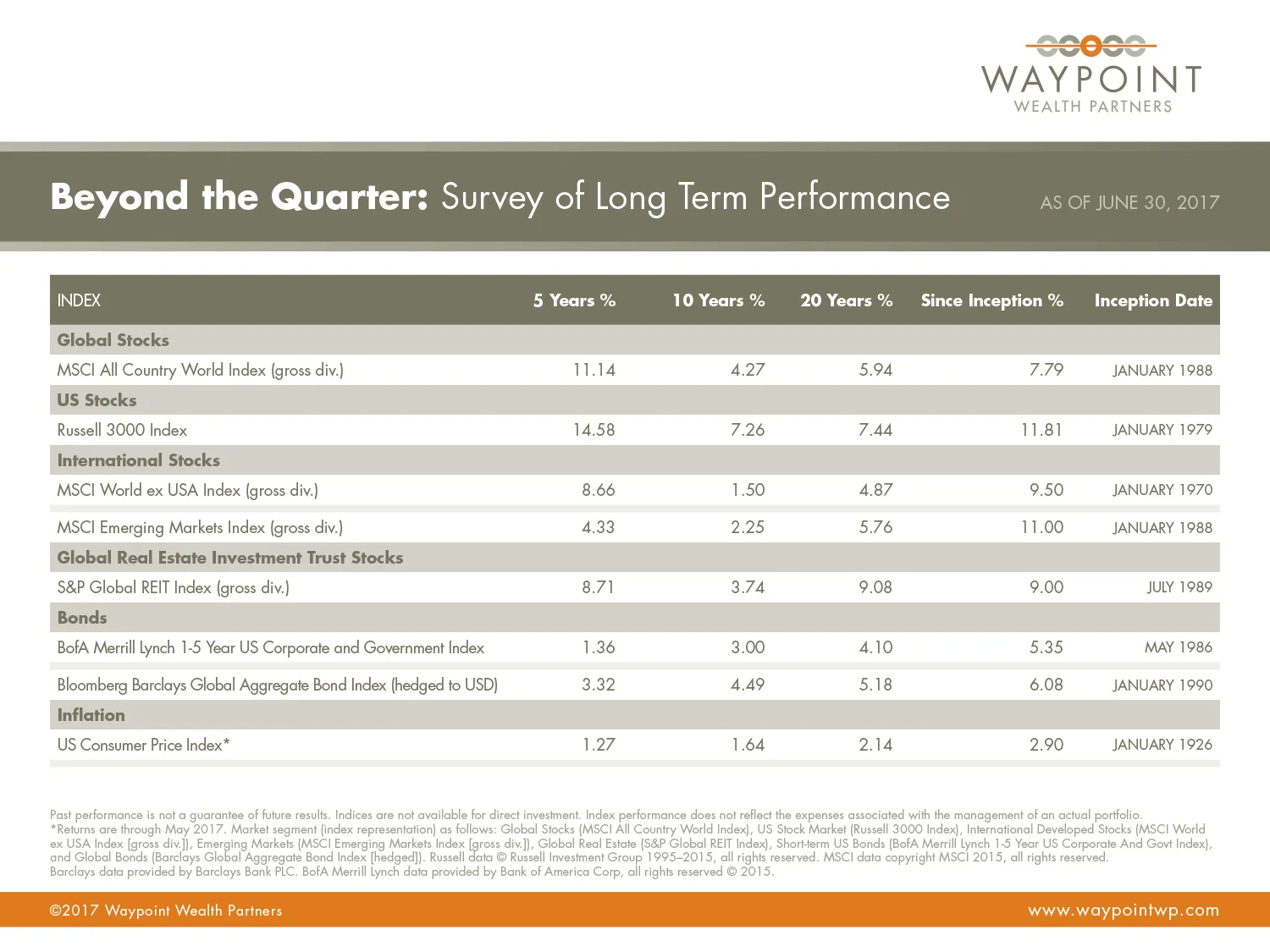

The Federal Reserve continued its plan to normalize monetary policy by raising interest rates by 25bps in June, reaffirming their view that the U.S. economy is healthy. This is the fourth rate hike in this tightening cycle, taking the federal funds rate to 1-1.25%. The Federal Reserve amassed a $4.5T portfolio through quantitative easing, whereby the central bank would purchase bonds from the market to lower interest rates and increase money supply. As another sign of confidence in the economy, the central bank announced details on how they would reduce their $4.5T portfolio over time and would no longer purchase bonds as securities mature. We don’t know when this program will begin, but Janet Yellen, the Federal Reserve Chair, suggested it would occur later this year. Despite the rate hike and announced plans to wind down their balance sheet, the bond markets were positive for the quarter. The U.S. bond market returned 1.45% while global bonds returned 0.60%. We expect the actions taken by the central bank to push bond yields higher and will continue to closely monitor how the bond markets react to this new environment. We will remain flexible in our approach to investing in fixed income and continue to own both short and intermediate bonds.

STOCKS

Stocks across the globe had another strong quarter. S&P 500 continued its eight year bull market and reached new highs during the quarter. Despite mixed economic data and political uncertainty around the administration’s ability to push through fiscal stimulus (tax cuts and infrastructure spending), S&P 500 returned 3.1%. Solid earnings growth continues to provide support in domestic equity markets. International and emerging markets continued its strong momentum and led the way returning 5.6% and 6.4% respectively. European equities rallied on reduced political risks, better economic data, and improved corporate earnings. Emerging markets had the strongest return, buoyed by improved global economic conditions, stronger local currencies, and better economic data coming out of China. Valuations in Europe and emerging markets remain attractive relative to the United States. Real Estate Investment Trusts (REITs) produced positive returns for the quarter with international real estate earning 2.6% and U.S. returning 1.6%.

ECONOMY

The U.S. economy remains strong and continues to grow at a slow and steady rate as it enters its ninth year of economic expansion, but recent data has been mixed. The labor market remains healthy and continues to add jobs at a healthy clip. In June, the economy added 220,000 jobs, which was stronger than expected. The unemployment rate is now at 4.4%, down from its peak at 10% in 2009. Inflation measures on the other hand have softened in recent months. Inflation peaked in February when the personal consumption expenditure, an inflation measure used by the Federal Reserve, pushed above 2%. Since then, falling energy prices and lower cellular costs pushed inflation back below the central bank’s target of 2%. The global economy continues to make healthy strides and show improvement. Recent global manufacturing data shows faster growth in the second quarter than at any time in the past six years.

The Uncertainty Paradox

Doubt is not a pleasant condition, but certainty is an absurd one.—Voltaire.

“The market hates uncertainty” has been a common enough saying in recent years, but how logical is it? There are many different aspects to uncertainty, some that can be measured and some that cannot. Uncertainty is an unchangeable condition of existence. As individuals, we can feel more or less uncertain, but that is a distinctly human phenomenon. Rather than ebbing and flowing with investor sentiment, uncertainty is an inherent and ever-present part of investing in markets. Any investment that has an expected return above the prevailing “risk-free rate” (think T-Bills for US investors) involves trading off certainty for a potentially increased return.

Consider this concept through the lens of stock vs. bond investments. Stocks have higher expected returns than bonds largely because there is more uncertainty about the future state of the world for equity investors than bond investors. Bonds, for the most part, have fixed coupon payments and a maturity date at which principal is expected to be repaid. Stocks have neither. Bonds also sit higher in a company’s capital structure. In the event a firm goes bust, bondholders get paid before stockholders. So, do investors avoid stocks in favor of bonds as a result of this increased uncertainty? Quite the contrary, many investors end up allocating capital to stocks due to their higher expected return. In the end, many investors are often willing to make the tradeoff of bearing some increased uncertainty for potentially higher returns.

MANAGING EMOTIONS

While the statement “the market hates uncertainty” may not be totally logical, it doesn’t mean it lacks educational value. Thinking about what the statement is expressing allows us to gain insight into the mindset of individuals. The statement attempts to personify the market by ascribing the very real nervousness and fear felt by some investors when volatility increases. It is recognition of the fact that when markets go up and down, many investors struggle to separate their emotions from their investments. It ultimately tells us that for many an investor, regardless of whether markets are reaching new highs or declining, changes in market prices can be a source of anxiety. During these periods, it may not feel like a good time to invest. Only with the benefit of hindsight do we feel as if we know whether any time period was a good one to be invested. Unfortunately, while the past may be prologue, the future will forever remain uncertain.

STAYING IN YOUR SEAT

In a recent interview, David Booth was asked about what it means to be a long-term investor:

“People often ask the question, ‘How long do I have to wait for an investment strategy to pay off? How long do I have to wait so I’m confident that stocks will have a higher return than money market funds, or have a positive return?’ And my answer is it’s at least one year longer than you’re willing to give. There is no magic number. Risk is always there.”

Part of being able to stay unemotional during periods when it feels like uncertainty has increased is having an appropriate asset allocation that is in line with an investor’s willingness and ability to bear risk. It also helps to remember that, during what feels like good times and bad, one wouldn’t expect to earn a higher return without taking on some form of risk. While a decline in markets may not feel good, having a portfolio you are comfortable with, understanding that uncertainty is part of investing, and sticking to a plan that is agreed upon in advance and reviewed on a regular basis can help keep investors from reacting emotionally. This may ultimately lead to a better investment experience.

--

Adopted from the “The Uncertainty Paradox” on Dimensional’s website, February, 2017. Dimensional Fund Advisors LP (“Dimensional”) is an investment advisor registered with the Securities and Exchange Commission. Diversification does not eliminate the risk of market loss. There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. This content is provided for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services..