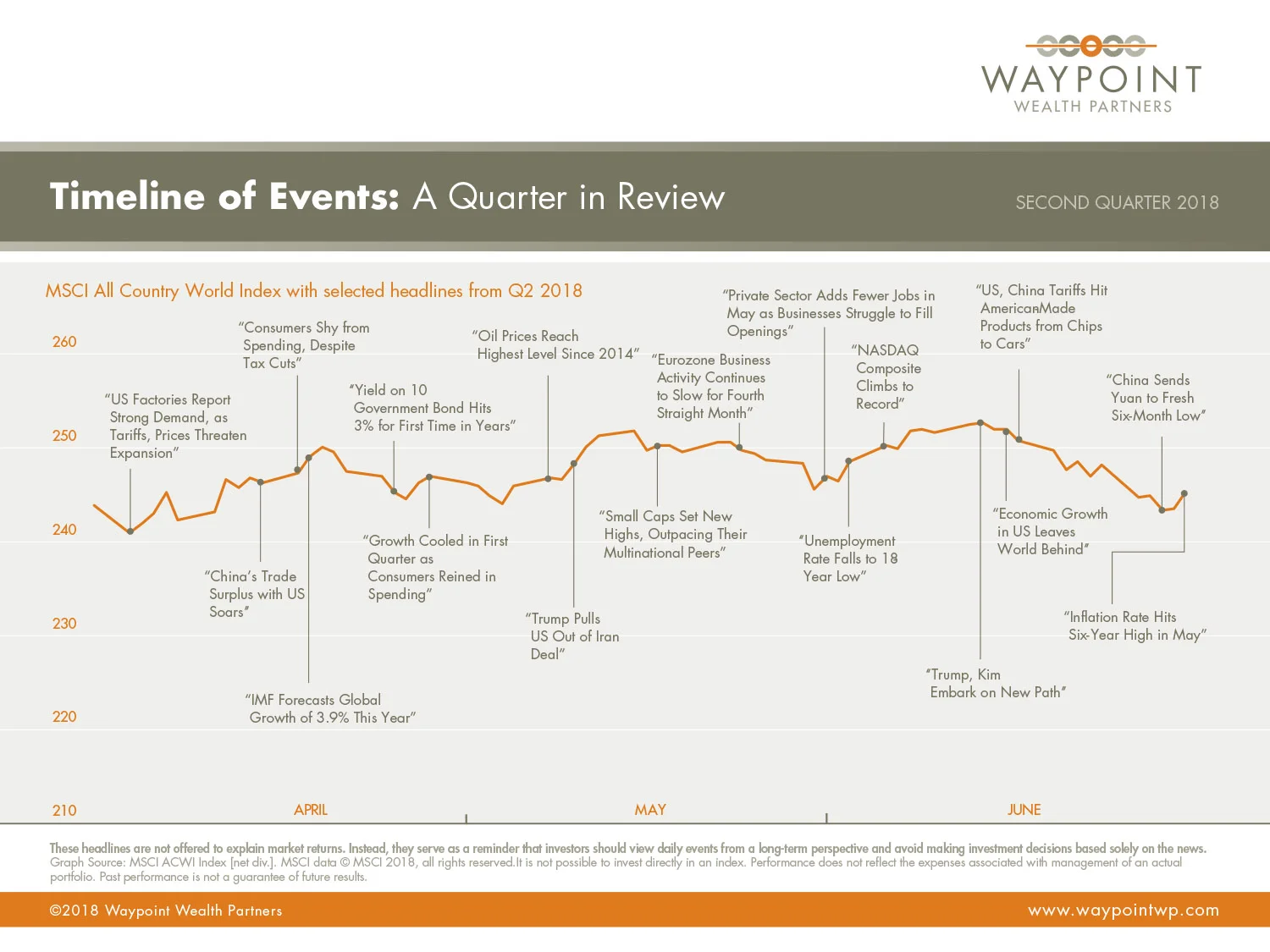

Market volatility continued in the second quarter as trade war fears took center stage. As of this writing, the U.S. has imposed tariffs on about 2% of all U.S. imports, while other countries have placed tariffs on 1% of all U.S. exports. Tariffs at these levels have minimal impact on our economy, but uncertainty around how far and deep they will go will continue to put a lid on the markets. Protectionist measures lead to higher inflation and slower economic growth, hurting all parties involved. The possibility of an outright trade war is overshadowing really strong earnings and positive economic growth around the world.

BONDS

Fixed income markets finished the quarter relatively flat as interest rates drifted higher. U.S. bonds returned -0.16% and municipal bonds earned 0.87%. The central bank increased the Federal Funds Rate by 25bps in June and increased the forecast from one to two additional rate hikes this year. The Fed chairman cited solid economic growth and stronger inflation expectations as reasons for the increase. Despite the central bank’s rate hikes and balance sheet reduction plan, financial conditions remain favorable. The historical average for the Federal Funds Rate is between 4-5%, much higher than the 2% rate today. As the Federal Reserve continues to normalize policy, volatility in bonds may persist. Given where we are in the economic cycle and the direction of interest rates, we find it paramount to own high quality bonds while being cautious of interest rate risk.

STOCKS

Stock markets across the globe experienced very different outcomes. U.S. equities remained resilient, earning 3.89%. Elevated trade concerns and geopolitical risks were outweighed by strong fundamentals as tax reform continued to provide a short-term boost to the U.S. economy. International stocks finished down slightly, returning -0.75%. Political concerns around the far-right movement resurfaced and economic growth moderated from unsustainably high levels. On the bright side, international markets are still in the middle of an economic expansion and fundamentals remain positive. Emerging markets had the toughest quarter, returning -7.96%. Escalated trade threats between the U.S. and China, combined with a stronger U.S. dollar and negative headlines around Turkey and Brazil hurt emerging market stocks, but the outlook remains encouraging for long-term investors. We continue to see good growth, strong consumer activity, improved balance sheets, and attractive valuations in emerging markets.

ECONOMY

We anticipated trade threats would slow down global growth if tariffs were escalated and that played out this quarter. Global momentum cooled a bit from last year’s neck breaking pace, but it remains in positive territory. Trade tensions and bad weather in Europe and Japan contributed to the slowdown. While other countries around the world are experiencing some pause, the U.S. continues full steam ahead. Tax reform has provided a shot in the arm to the economy, taking growth above average. The U.S. is now in the tenth year of an economic expansion, the second longest on record. We expect economic growth to go back to normal levels in 2019 as benefits from fiscal stimulus diminish and interest rates rise due to strong growth and below average unemployment levels.

--

--

Sailing with the Tides

Embarking on a financial plan is like sailing around the world. The voyage won’t always go to plan, and there’ll be rough seas. But the odds of reaching your destination increase greatly if you are prepared, flexible, patient, and well-advised.

A mistake many inexperienced sailors make is not having a plan at all. They embark without a clear sense of their destination. And once they do decide, they often find themselves lost at sea in the wrong boat with inadequate provisions.

Likewise, in planning an investment journey, you need to decide on your goal. A first step might be to consider whether the goal is realistic and achievable. For instance, while you may long to retire in the south of France, you may not be prepared to sacrifice your needs today to satisfy that distant desire.

Once you are set on a realistic destination, you need to ensure you have the right portfolio to get you there. Have you planned for multiple contingencies? What degree of “bad weather” can your plan withstand along the way?

Key to a successful voyage is a good navigator. A trusted advisor is like that, regularly taking coordinates and making adjustments, if necessary. If your circumstances change, the advisor may suggest you replot your course.

As with the weather at sea, markets can be unpredictable. A sudden squall can whip up waves of volatility, tides can shift, and strong currents can threaten to blow you off course. Like a seasoned sailor, an experienced advisor will work with the conditions.

Once the storm passes, you can pick up speed again. Just as a sturdy vessel will help you withstand most conditions at sea, a well-diversified portfolio can act as a bulwark against the sometimes tempestuous conditions in markets.

Circumnavigating the globe is not exciting every day. Patience is required with local customs and paperwork as you pull into different ports. Likewise, a lack of attention to costs and taxes is the enemy of many a long-term financial plan.

Distractions can also send investors, like sailors, off course. In the face of “hot” investment trends, it takes discipline not to veer from your chosen plan. Like the sirens of Greek mythology, media pundits can also be diverting, tempting you to change tack and act on news that is already priced in to markets.

A lack of flexibility is another impediment to a successful investment journey. If it doesn’t look as though you’ll make your destination in time, you may have to extend your voyage, take a different route to get there, or even moderate your goal.

The important point is that you become comfortable with the idea that uncertainty is inherent to the investment journey, just as it is with any sea voyage. That is why preparation and planning are so critical. While you can’t control every outcome, you can be prepared for the range of possibilities and understand that you have clear choices if things don’t go according to plan.

If you can’t live with the volatility, you can change your plan. If the goal looks unachievable, you can lower your sights. If it doesn’t look as if you’ll arrive on time, you can extend your journey.

Of course, not everyone’s journey is the same. Neither is everyone’s destination. We take different routes to different places, and we meet a range of challenges and opportunities along the way.

But for all of us, it’s critical that we are prepared for our journeys in the right vessel, keep our destinations in mind, stick with the plans, and have a trusted navigator to chart our courses and keep us on target.

--

Past performance is no guarantee of future results. There is no guarantee an investing strategy will be successful. Diversification does not eliminate the risk of market loss.

All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

©2018 Dimensional Fund Advisors LP. All rights reserved. Unauthorized copying, reproducing, duplicating, or transmitting of this material is prohibited.

--