Stocks and bonds around the world fared well in the third quarter as the global economy continued to lumber along at a slow pace. The forthcoming presidential election, interest rates and central bank policy continued to dominate economic headlines. As the shock from the Brexit vote faded, markets settled into their familiar summer calm for most of the quarter. September brought with it a brief period of heightened volatility as news out of the US Federal Reserve’s annual Jackson Hole retreat indicated that a rise in interest rates may be on the horizon sooner than the market expected.

BONDS

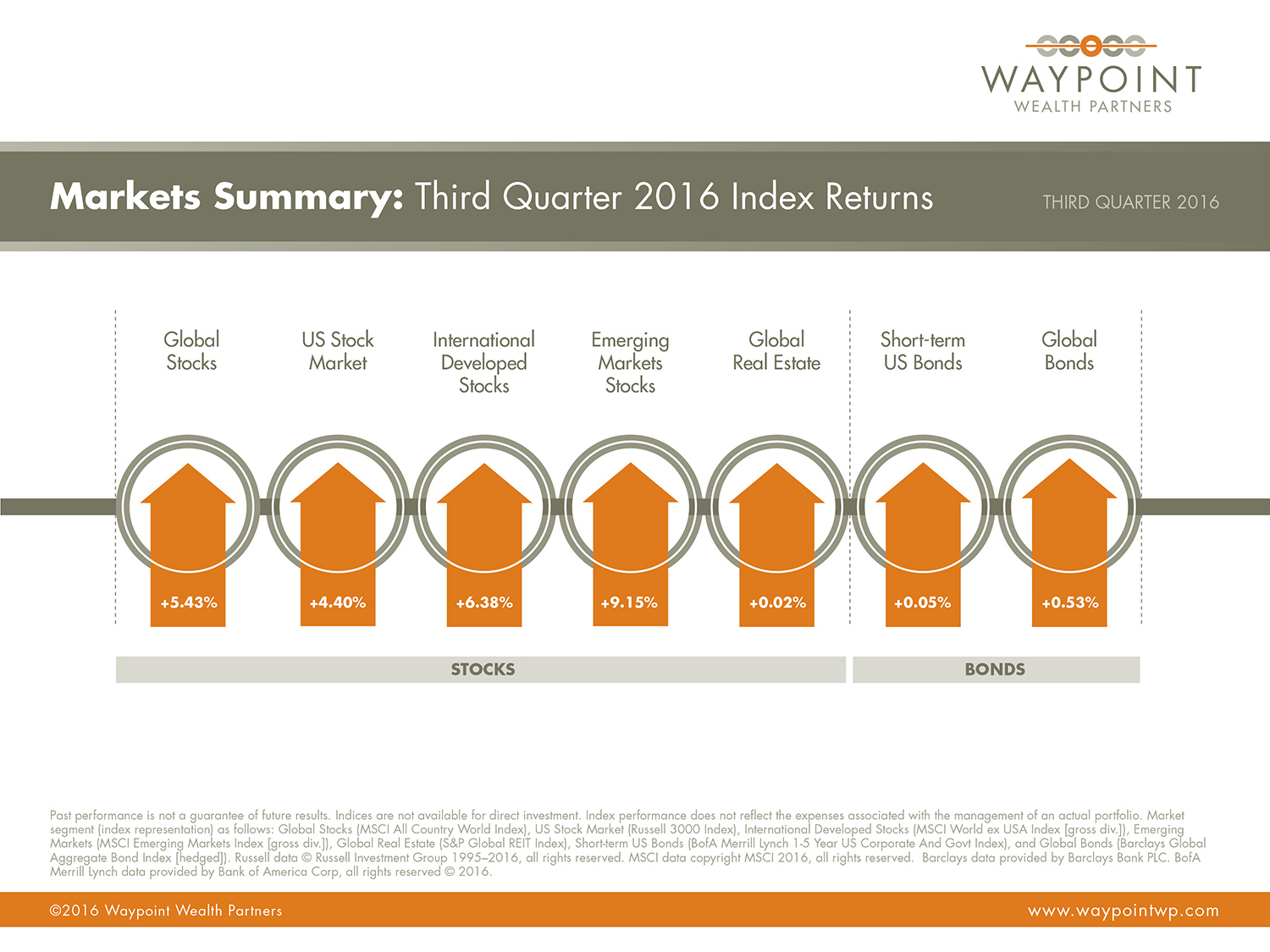

A subdued and uncertain global growth backdrop, low inflation and demand for the safety and yield of fixed income instruments continued to support bond markets around the world. Worries that central banks would reduce their supportive policies rattled investors in early September but markets were quickly assuaged by comments to the contrary from the US Fed and the Bank of Japan. Interest rates on short-term and intermediate government bonds rose slightly over the quarter. The yield on the 10-year US Treasury Bond saw an increase of 0.11%, from 1.49% to 1.60%, which was the first quarterly increase this year for the benchmark security. The small jump in rates kept returns largely flat. The broad US bond market managed to produce a slightly positive return of 0.46% and the global market as a whole earned 0.53%.

STOCKS

Equities rebounded early in the quarter from the uncertainty brought about by the Brexit vote in late June and US stocks reached new highs in mid-August. Overall, performance around the world was positive. Emerging markets continued to build on a strong year with a return of 9.15% for the quarter and were once again the best performing equity asset class for the period. International developed markets earned 5.43% while US markets finished the quarter 4.40% higher. US Real Estate Investment Trusts (REITs) struggled with a loss of -1.31% while their international counterparts fared better with a positive return of 2.27%.

ECONOMY

Conflicting economic data continued to complicate the path forward for central bank policy. The US economy welcomed a pick up in wage growth that has long been absent and the overall labor market continued to produce healthy statistics. At the same time, economic growth and inflation remained low. The Fed is in a difficult position and must decide which variable to favor given their dual mandate to pursue a strong labor market and produce a healthy level of inflation. The environment in developed markets outside the US remains less sanguine with slow growth and no signs of acceleration in the near-term. The United Kingdom shrugged off any immediate impact from Brexit for the time being with a stimulus package that appeared to provide support for the economy in the wake of the vote. Elsewhere in Europe, the economic prospects remain stuck in neutral. The European Central Bank kept its expansionary policy in place and while there has been improvement, the overall results were lackluster. Emerging market economies continued to stabilize with the help of more steady currency and commodity prices and continued low interest rates. Economic growth in China appeared to be following the “soft landing” scenario as they continue to rebalance their economy. Growth in the country has settled in around 6.5%. This is a much more desirable outcome both for the Chinese and global economy than the so called “hard landing.” The consensus view for the global economy remained unclear but plenty of caution from policymakers and economists alike was the dominate theme. With the US presidential election right around the corner, markets will be able to check one significant unknown off the list in the near future.

10 Reasons to be Cheerful

Do you ever listen to the news and find yourself thinking that the world has gone to the dogs? The roll call of depressing headlines seems endless. But look beyond what the media calls news, and there also are a lot of things going right.

It’s true the world faces challenges in many areas, and the headlines reflect that. But it’s also easy to overlook the significant advances made in raising the living standards of millions, increasing global cooperation on various issues, and improving access to healthcare and other services across the world.

Many of the 10 developments cited below don’t tend to make the front pages of daily newspapers or the lead items in the TV news, but they’re worth keeping in mind on those occasions when you feel overwhelmed by all the grim headlines.

So here’s an alternative news bulletin:

- Over the last 25 years ending May 2016, one million dollars invested in a global portfolio of stocks would have grown to more than five and a half million dollars.1

- Over the last 25 years, 2 billion people globally have moved out of extreme poverty, according to the latest United Nations Human Development Report.2

- Over the same period, mortality rates among children under the age of 5 have fallen by 53%, from 91 deaths per 1000 to 43 deaths per 1000.

- Globally, life expectancy has been improving. From 2000 to 2015, according to the World Health Organization, the global increase was 5.0 years, with an even larger increase of 9.4 years in parts of Africa.3

- Global trade has expanded as a proportion of GDP from 20% in 1995 to 30% by 2014, signaling greater global integration.4

- Access to financial services has greatly expanded in developing countries. According to the World Bank, among adults in the poorest 40% of households within developing economies, the share without a bank account fell by 17 percentage points on average between 2011 and 2014.5

- The world’s biggest economy, the US, has been recovering. Unemployment has halved in six years from nearly 10% to 5%.6

- The world is exploring new sources of renewable energy. According to the International Energy Agency, in 2014, renewable energy such as wind and solar expanded at its fastest rate to date and accounted for more than 45% of net additions to world capacity in the power sector.7

- We live in an era of innovation. One report estimates the digital economy now accounts for 22.5% of global economic output.8

- The growing speed and scale of data is increasing global connectedness. According to a report by McKinsey & Company, cross-border bandwidth has grown by a factor of 45 in the past decade, boosting productivity and GDP.9

No doubt many of these advances will lead to new business and investment opportunities. Of course, not all will succeed. But the important point is that science and innovation are evolving in ways that may help mankind.

The world is far from perfect. The human race faces challenges. But just as it is important to be realistic and aware of the downside of our condition, we must also recognize the major advances that we are making. Just as there is reason for caution, there is always room for hope. And keeping those good things in mind can help when you feel overwhelmed by all the bad news.

1. As measured by the MSCI All Country World Index (gross dividends) in USD.

2. “Human Development Report 2015: Work for Human Development,” United Nations.

3. “World Health Statistics 2016,” World Health Organization.

4. “International Trade Statistics 2015,” World Trade Organization.

5. “The Global Findex Database 2014: Measuring Financial Inclusion Around the World,” World Bank.

6. US Bureau of Labor Statistics, 15 March 2016.

7.“Renewable Energy Market Report 2015,” International Energy Agency.

8. “Digital Disruption: The Growth Multiplier,” Accenture and Oxford Economics, February 2016.

9. “Digital Globalization: The New Era of Global Flows,” McKinsey and Company, March 2016.

Adapted from “10 Reasons to be Cheerfulf” by Jim Parker, Outside the Flags column on Dimensional’s website, June 2016. Dimensional Fund Advisors LP (“Dimensional”) is an investment advisor registered with the Securities and Exchange Commission. Diversification does not eliminate the risk of market loss. There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. This content is provided for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.