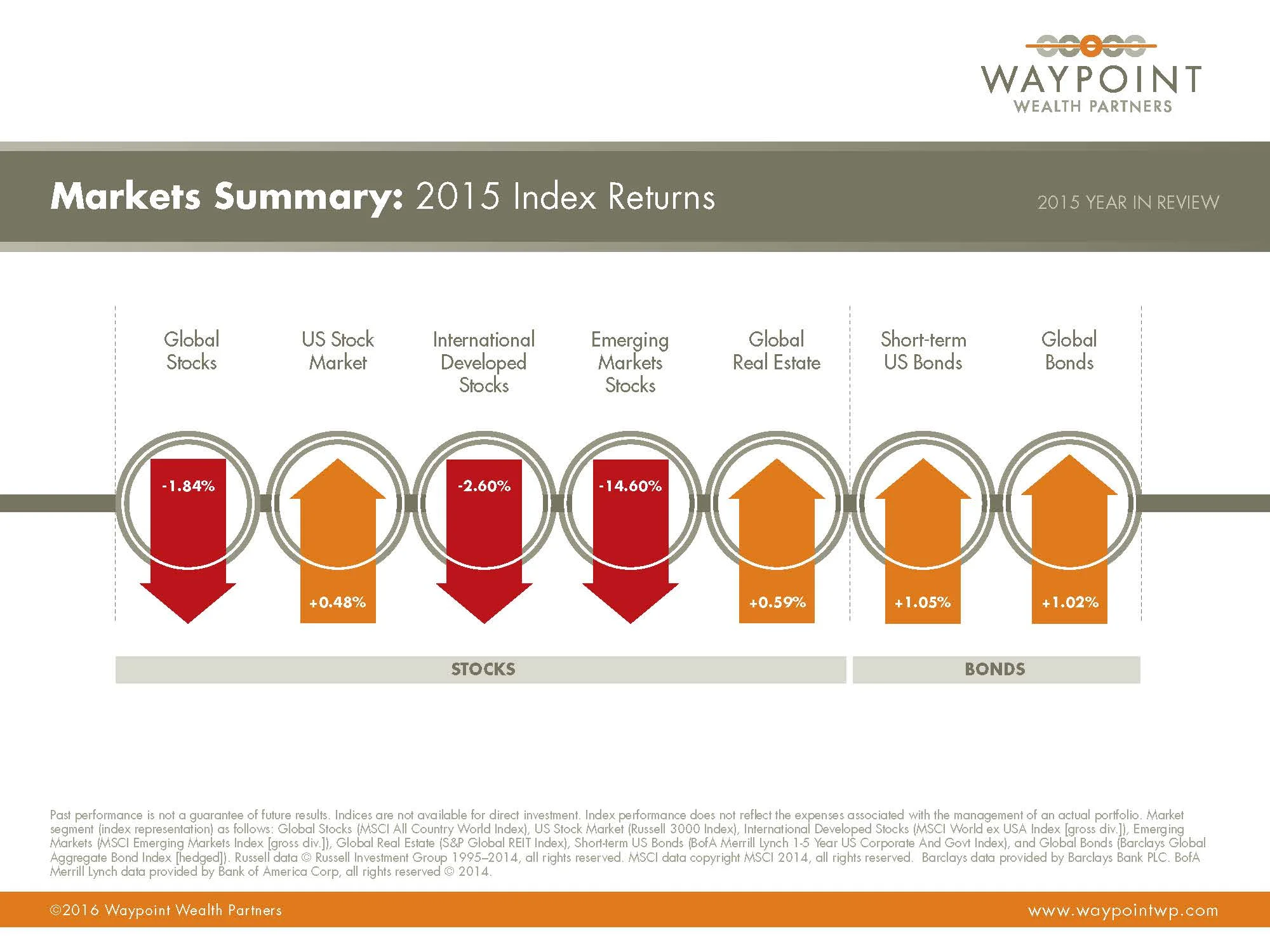

2015 provided another example of how dynamic and rapidly changing our world is. Significant events included the highest job growth since 1999, two downgrades to the global economy, the Federal Reserve raising interest rates for the first time since 2006, Russia getting directly involved in the Syrian conflict, which pushed the immigrant crisis to levels not seen since WWII, and a dramatic rise and fall of the Chinese stock market. Despite all these events, 2015 provided quite unremarkable investment returns. US markets were slightly up, European markets slightly down, global real estate and global bonds slightly up and emerging markets down double digits. Volatility is back as markets try to digest the impact of these events and we expect that to continue through 2016.

BONDS

The US Federal Reserve finally increased interest rates in December. It has been a long time coming and the overall reaction in the bond market was muted, which is not surprising since this single event, and the anticipation of it, has been the dominant force in the market for many years. As expected, bond yields did inch up higher in 2015. Benchmark 10 year US Treasury bonds began the year paying 2.12% and ended the year with a yield of 2.27%. Despite the much anticipated volatility many feared rising rates might have caused, short and intermediate term high quality bonds proved their worth by remaining relatively stable. In contrast to the US, central banks in the developed world continued to keep rates low. For the year, short term (1-5 year) US bonds earned 1.05%, the broad US bond market returned 0.55% and global bonds earned 1.02%.

STOCKS

In the fourth quarter, global equities reversed much of what was lost in Q3. Even with the positive performance over the last three months, the rally that took place in equity markets around the world beginning in 2009 lost its momentum in 2015. Earnings growth weakened domestically and continued to move in the wrong direction in international developed and emerging markets, which weighed on prices. US stocks ended the year up 0.48%, international developed stocks lost 2.60% and emerging market stocks fared the worst, posting a 14.60% drop. Value companies continued to underperform the broader market around the world while small companies lagged in the US but managed to outperform international markets. US real

estate investment trusts (REITs) earned 2.54% while their international counterparts lost 2.77%.

ECONOMY

The common wisdom is that the Fed increased interest rates because they have enough confidence in the strength of the US economy. It may also be interpreted as a cautious move. Prior to the recent increase, the Fed’s ability to react to a future recession was limited. They now have more room to maneuver if required to do so. US data supports both points of view. GDP growth remained positive, the jobs picture continued to improve and inflation is under control. At the same time, there was some weakness in the housing market over the last few months, manufacturing is softening and inventory levels are dropping (which can be a leading indicator of economic weakness). In any case, with rates above zero, the economy will truly need to stand on its own. In Europe, the economic recovery continues to stay on track after renewed commitments from the European Central Bank to maintain a “whatever it takes” stance to support the recovery. The Japanese economy faces similar circumstances to Europe. Supportive monetary policy and guidance by Japanese officials helped GDP growth recover after a negative report in the first quarter of 2015. In emerging markets, the drop in commodity prices has been devastating for many economies that rely on natural resource exports. At the same time, the increase in US interest rates also rattled the developing world. The cheap money created by low rates in the US flowed into emerging markets and these funds are now reversing course, starving many economies of capital. We are a long way from the final judgement on the efficacy of the unprecedented central banks policies in place since the financial crisis of 2007-2008, but we are finally nearing the beginning of the end.

Ten Predictions to Count On

The New Year is a customary time to speculate. In a digital age, when past forecasts are available online, market and media professionals find it harder to hide their blushes when their financial predictions go awry.

The folly that goes with making bold forecasts was highlighted in a recent newspaper article, which listed many bad calls US economists had made about 2015. These included getting the timing of the Federal Reserve’s interest rate increase wrong, incorrectly calling for a rise in long-term bond yields, and assuming an end to the commodity rout. (1)

For the broad US equity market, 22 strategists polled by the Wall Street Journal (2) estimated an average increase for the S&P 500 of 8.2% for 2015. The most optimistic individual forecast was for a rise of 14%. The least optimistic was 2%. No one picked a fall. As it turned out, the benchmark ended marginally lower for the year.

In the UK, a poll of 49 fund managers, traders, and strategists published in early January 2015 forecast that the FTSE 100 index would be at 6,800 by midyear and 7,000 points by year-end. As it turned out, the FTSE surpassed that year-end target by late April to hit a record high of 7,103 before retracing to 6,242 by year-end. (3)

It shouldn’t be a surprise that if economists can’t get the broad variables right, it must be tough for stock analysts to pick winners. Even a stock like Apple, which for so many years surprised on the upside, disappointed some forecasters last year with a 4.6% decline. (4)

It should be evident by now that setting your investment course based on someone’s stock picks or expectations for interest rates, the economy, or currencies is not a viable way of building wealth in the long term. Markets have a way of confounding your expectations. So a better option is to stay broadly diversified and set an asset allocation that matches your own risk appetite, goals, and circumstances.

Of course, this approach doesn’t stop you or anyone else from having or expressing an opinion about the future. We are all free to speculate about what might happen in the economy and markets. The danger comes when you base your investment strategy on such opinions. In the meantime, if you insist on following forecasts, here is a list of 10 predictions you can count on coming true in 2016:

1. Markets will go up some of the time and down some of the time.

2. There will be unexpected news. Some of this will move prices.

3. Acres of newsprint will be devoted to the likely path of interest rates.

4. Acres more will speculate on China’s growth outlook.

5. TV pundits will frequently and loudly debate short-term market direction.

6. Some economies will strengthen. Others will weaken. These change year to year.

7. Some companies will prosper. Others will falter. These change year to year.

8. Parts of your portfolio will do better than other parts. We don’t know which.

9. A new book will say the rules no longer work and everything has changed.

10. Another new book will say nothing has really changed and the old rules still apply.

You can see from that list that if forecasts are so hard to get right, you are better off keeping them as generic as possible. Like a weather forecaster predicting wind, hail, heat, and cold over a single day, your audience should prepare themselves for all climates.

The future is always uncertain. There are always unexpected events. Some will turn out worse than you expect; others will turn out better. The only sustainable approach to that uncertainty is to focus on what you can control.

1. Malcolm Maiden, “The Year Market Economists Failed to See Coming,”

SMH, December 30, 2015.

2. “Strategists Expect Stocks to Keep Climbing in 2015,” Wall Street Journal,

January 2, 2015.

3. “Five Fund Strategies to Ride Rising Markets,” The Times, January 3, 2015.

4. “Seven Stocks to Buy for 2015,” CNN Money, December 31, 2014.